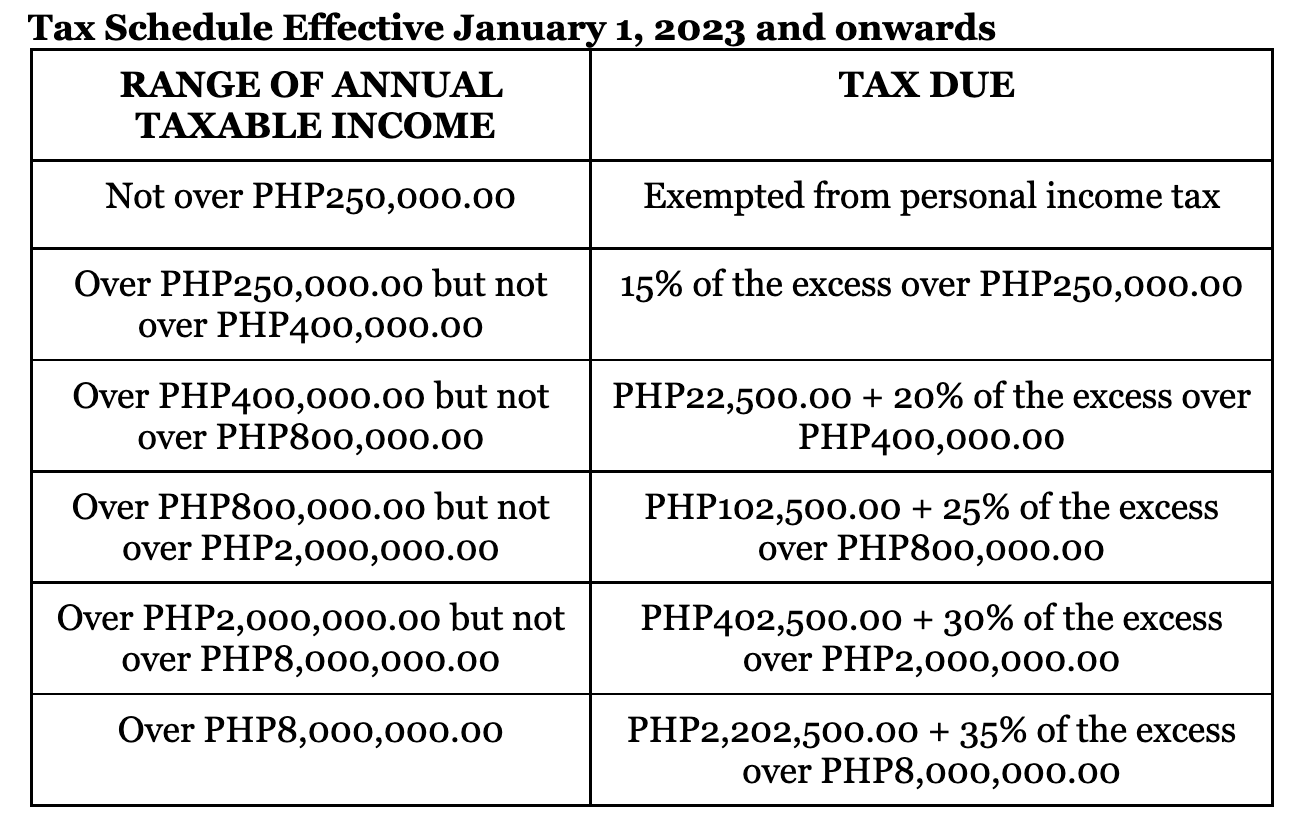

2025 Graduated Tax Table

2025 Graduated Tax Table. The federal tables below include the values applicable when determining federal taxes for 2025. Graduated income tax rates for january 1, 2025 and onwards:

Taxes Applicable to SoleProprietors, Freelancers, SelfEmployed and, The 2025 tax brackets apply to income. Federal tax brackets for 2025?

Tax rates for the 2025 year of assessment Just One Lap, There are five filing statuses and seven. Indexed tax tables for 2025.

10+ Calculate Tax Return 2025 For You 2025 VJK, The 2025 tax brackets apply to income. Stay informed about tax regulations and calculations in nigeria in 2025.

Withholding Tax Table 2018 Philippines, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. Discover the philippines tax tables for 2025, including tax rates and income thresholds.

Tax Table 2025 Philippines Latest News Update, Taxable income how to file your taxes: Your bracket is determined by how much taxable income you receive each year and your filing status.

BIR Tax Schedule Effective January 1 2025, Indexed tax tables for 2025. These rates apply to your taxable income.

RB20221010 New BIR Tax Tables Effective January 1, 2025 Titanium, Stay informed about tax regulations and calculations in nigeria in 2025. The 2025 tax brackets apply to income.

Withholding Tax Table 2019, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. Indexed tax tables for 2025.

2025 Top Tax Rate Dasha Emmalee, For 2025, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total). Taxable income how to file your taxes:

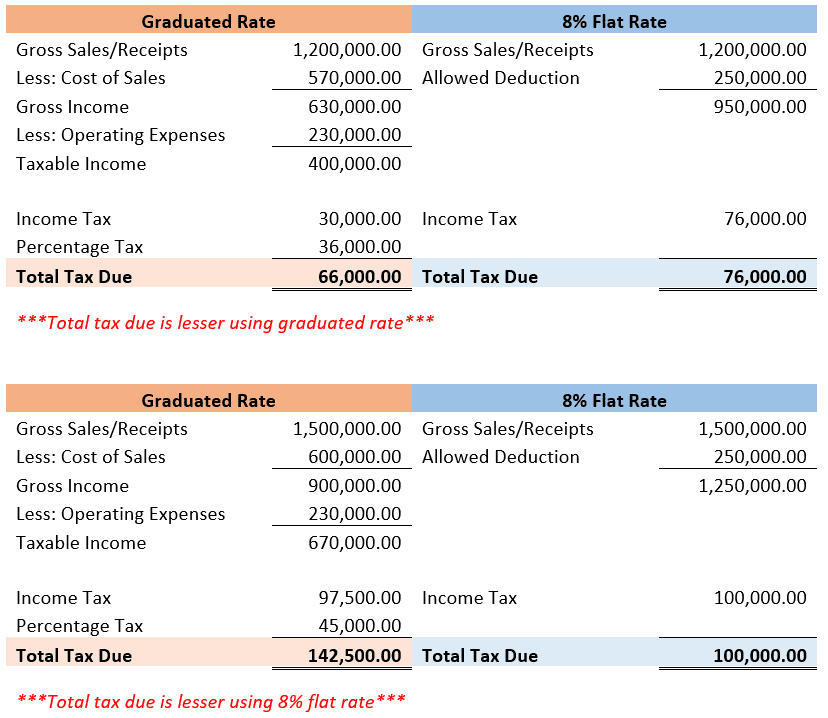

[Ask the Tax Whiz] How to compute tax under the new tax, There are seven income tax rates for the 2025 tax year, ranging from 10% to 37%. For 2025, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total).